5 reasons brands should continue advertising during a downturn

Amidst the COVID-19 pandemic, global markets are in turmoil and warnings of an imminent recession are spreading.

The instinct of many business leaders is a focus on cashflow preservation. Marketing budgets are often the first to be cut as leaders seek to yield noticeable returns quickly. And in the short-term, this can help.

However, economist Peter Field, backed by numerous studies, has warned that while cutting ad budgets is a temporary fix to a short-term deficit, it could put brands at a significant competitive disadvantage during the recovery period.

1. CONSUMER SHARE OF MIND IS HARD TO RECOUP

Consumers tend to make decisions using “System 1” thinking – at the subconscious level

Nobel Prize winner Daniel Kahneman uncovered that most consumer decisions, are made subconsciously and automatically – known as ‘System 1’ thinking. It is said that only 5% of our cognitive activity is experienced at a conscious level.

Brands within a consumer’s initial consideration set are 3X more likely to be purchased

The brands that reach consumers at multiple touchpoints become part of a consumer’s initial consideration set of brands. McKinsey & Company has discovered that brands within this initial consideration set can be up to three times more likely to be purchased.

Even though consumers readily switch brands at the time of purchase, McKinsey & Company discovered that 69% of the brands that consumers switched to were part of their initial consideration set when they started shopping.

2.INCREASED RECOVERY COSTS OUTWEIGH SHORT-TERM SAVINGS

A Detriment to Future Sales

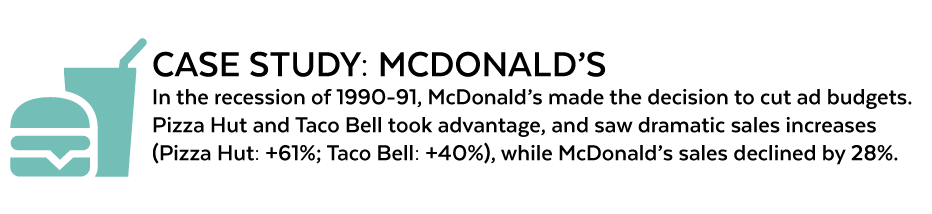

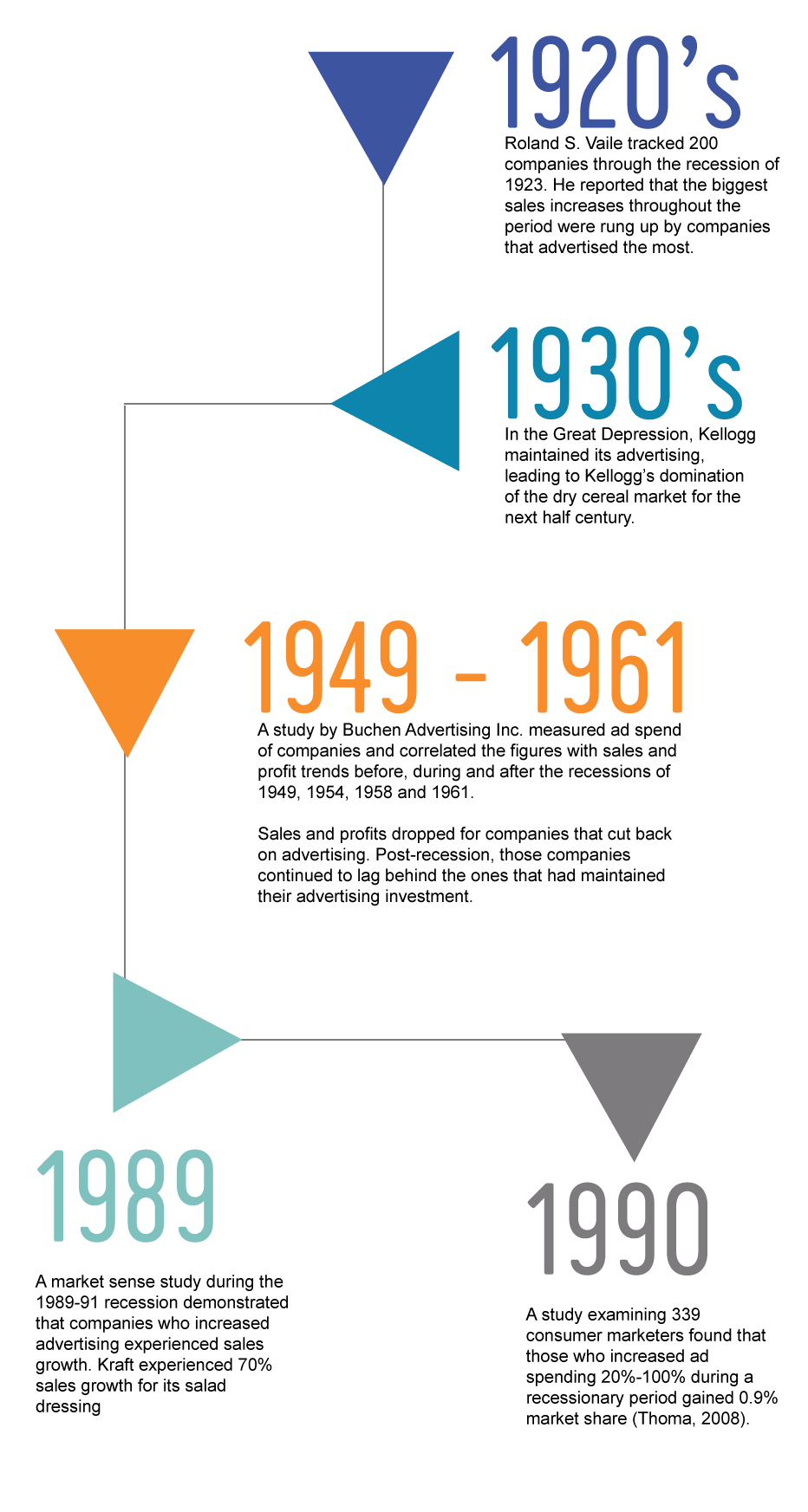

Various studies about advertising during times of economic downturn have shown that companies that fail to maintain share of mind during those times are likely to jeopardize current and future sales.

Cutting media and marketing spend can save a company money in the short-term, and they may not see any negative effects. However, over time their share of market and share of voice will deteriorate, and the impact to sales will be felt.

Binet found that firms that cut their ad spend increased 20-30% decreases in sales and income. Likewise, a study by Tony Hiller of 1,000 firms in the USA and Europe found that firms that decreased their ad spend saw a 0.8% loss during their recovery period.

The Path to Recovery

Economist Peter Field found that it can take up to five years for brands to recover from cutting their budgets during a recession.

While investing heavily in advertising following the crisis could help get back to pre-crisis levels more quickly, the cost of doing so would be substantially greater than the savings from cost cutting in the first place.

3.BRAND-BUILDING NOW LEADS TO LONG-TERM PROFITABILITY

Reduced Marketplace “Noise”

Recessions offer a rare opportunity for brands to improve their competitive advantage through increased marketing efforts. If competitors are cutting their budgets, the longer-term benefit of maintaining marketing expenditures will be even greater. What’s more, you can do this at lower cost than when times were good.

Short and Long Term Impact on Market Share and Profitability

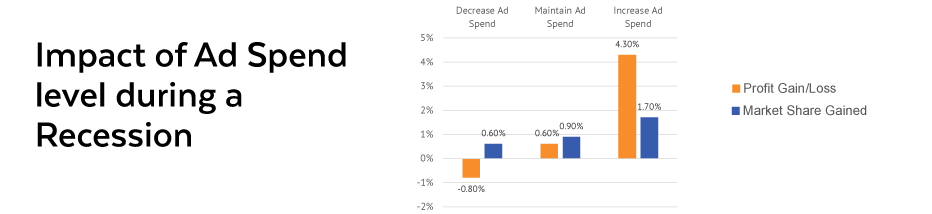

The studies by Binet and Hiller found that

- SHORT TERM: brands that cut their budgets were slightly more profitable than those who maintained or increased their spend. However those gains were overshadowed in the recovery period.

- RECOVERY PERIOD: during the first two years of the recovery period, brands that increased their marketing spend gained 1.7% of market share and experienced a 4.3% profit increase. Brand that cut their spend lost 0.8% in profit and only gained 0.6% market share.

Competitive Impact

As competitors cut their advertising budgets, a brand that increases or maintains ad spend will automatically increase its share of voice and share of market.

In essence, the brand’s spend will be more effective than it otherwise would be.

4. BENEFIT FROM A BUYER’S MARKET IN ADVERTISING

Increased Media Consumption + Increased Media Supply

As consumers are spending more time in their homes, they are consuming an increasing amount of media. In particular, TV and digital consumption are surging. According to IRi Worldwide, it is estimated that media consumption is up 70%.

Coupled with the increasing media consumption, media supply is increasing as the demand for it decreases (due to ad budget cuts).

As a result, it is likely that the industry will see short-term price decreases for inventory, improving the relative efficiency of advertising spending.

IRi Worldwide estimates that digital media costs are down about 40% and TV spot market costs are expected to decrease by 50%.

Prepare for More Competition, Less Avails During Recovery

Signs have pointed to a rebound as early as late Q2. When this happens, those companies that previously cut ad spend will likely flood the market. The resulting impact would be fewer avails, combined with increased competition and clutter in the marketplace.

5.ACQUIRE NEW CUSTOMERS

Brand response to the pandemic is affecting consumer behaviour

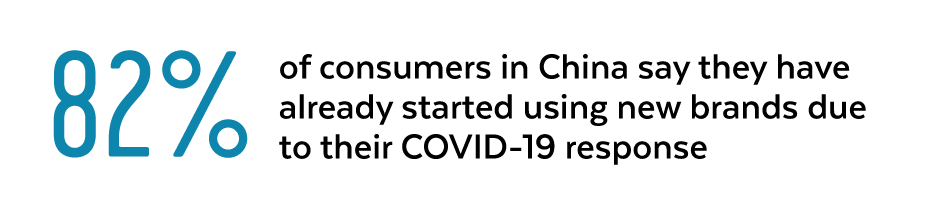

The 2020 Trust Barometer study by Edelman established the importance of brand response to the COVID-19 pandemic.

65% of consumers in the 12 global markets studied indicated that a brand’s response to the crisis will have a huge impact on their likelihood to purchase that brand in the future. This index jumps as high as 88% in China.

Similarly 37% of consumers globally say they have already started using new brands as a result of the way they’ve responded to the pandemic, along with 82% of consumers in China.

At the same time, consumers are punishing brands that they feel are not acting appropriately : 1/3 of consumers globally, and 76% of consumers in China have stopped using certain brands for this reason.

Consumers want brands to take action

The COVID-19 Barometer study by Kantar reports only 8% of consumers believe that brands should stop advertising during the Covid-19 outbreak whilst 74% of consumers think that companies should not exploit the situation.

Consumers are forming new habits at home

With consumers stuck at home, many are developing new habits and trying out new hobbies. Customers are trialing products they may not otherwise have considered. We expect to see brand and category shifts at an unprecedented level as consumers adjust to their “new normal.” These shifts provide an opportunity for brands to gain new customers, and remind existing customers of what they stand for.

“Brand health becomes vulnerable when companies stop advertising…If they do this for longer than six months it destroys both short- and long-term health.”

Jane Ostler -Global Head of Media Kantar Insights

“The best marketers will be upping, not cutting, their budgets … It’s one of the smartest plays in advertising and the reason why the likes of Kellogg’s, Procter & Gamble, Lucky Strike, Toyota and Colgate all have a special chapter in their corporate museums devoted to a specific recession… and won the decade that followed as a result”

Mark Ritson, Marketing Week